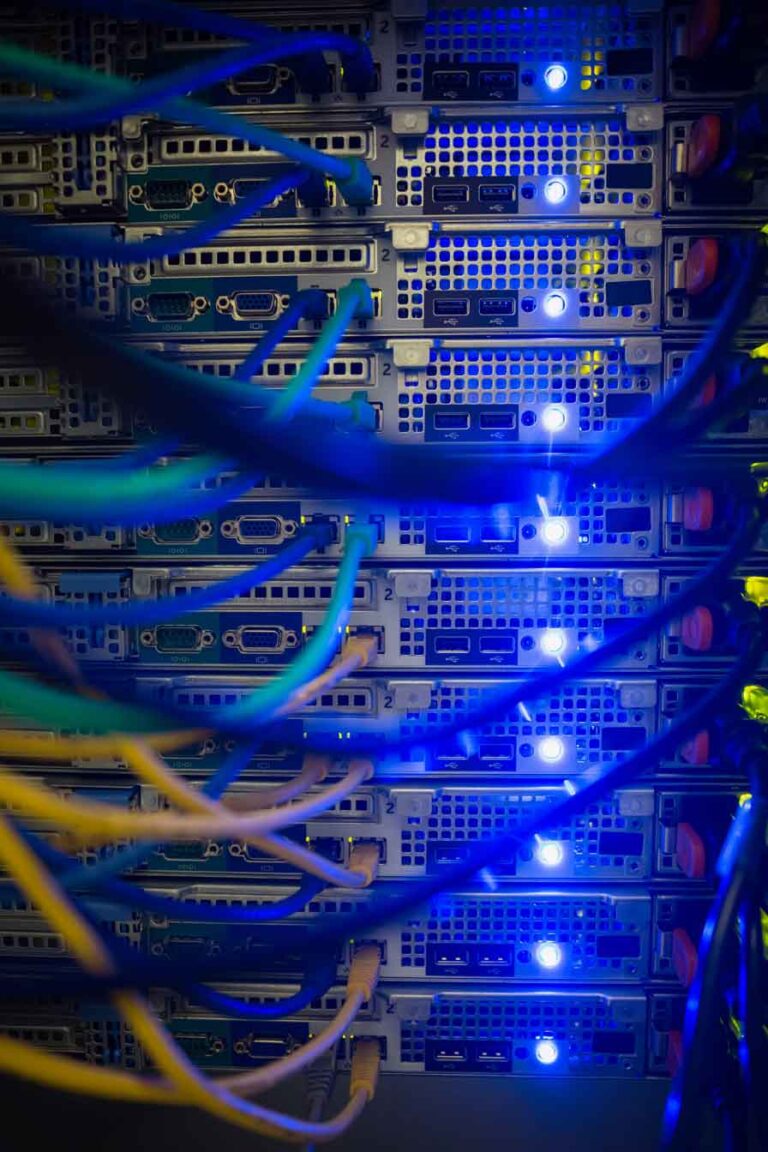

Datacenter

Story

During our discovery meeting with the CFO, our client expressed a desire to decrease the fraud and chargebacks and also reduce processing costs as well.

Following an analysis of the client’s ecosystem, we find out they are facing a 1.4% chargeback on average on monthly basis.

How we helped

Our firm negotiated with several other payment processors in addition to the one used by the client. A variety of options were presented to the client for approval.

Consequently, our team implemented the recurring payment with the CardBrands account updater, which automatically updated expired credit cards without contacting the customer directly.

Based on the type of transactions, the interchange rate was optimized. Additionally, we will implement a customized Virtual Terminal platform that all call center employees will be able to use for one-touch customer service.

Our client’s sales have increased over the past eight months. Our efforts resulted in our client being able to reduce 11% of their current processing fees as well as implement enhanced features for online security and detailed reporting.

Generally, this upgraded platform provides senior management with detailed reporting and employee management, resulting in increased productivity, increased revenue, and, most importantly, heightened customer satisfaction.

The watchlist service we provide to our clients was launched in 2020; therefore, our clients have experienced two rate increases, which we reported to our clients, and the client received a refund from the processor.

Result

Avrage Monthly CreditCard Valume: $2,555,000 USD

Annual processing valume: $30,660,000 USD

- Annual saving $212,086 USD

- NO rate increase since 2020!

- Reduced chargebacks by 68%

- Combination of annual processing fee and chargeback savings $415,000 USD

What we learned?

Over the past 24 month, online payment processing have increased by 800% due to the COVID19, which is created a fantastic opportunity for retailers. However, in the past 24 months, we have noticed fraudulent online credit card transactions have increased by 48%.

Online businesses tend to pay a higher rate because of the type of transaction they are receiving, which is known as CNP or Online transaction. There is also more risk associated with card not present transactions, which can threaten any online business.

Online businesses stay with their processor by average of two years more than any other industry because of the complexity and cost of integration and chance of downtime for the operation. This also results in a higher processing fee paid by the merchant.